What Is Trading Signal and How It Works

No matter what type of trading you’re in, you’ve obviously heard of trading signals. From beginners to veteran traders, everyone takes suggestions from these signals to make their next moves.

You can find or purchase signals from different trading signal platforms. Some even make their own site for their community. But what is a trade signal? Trade signals are clues that forecasts prices or outcomes of the decisions you might take.

Trading signals or trade signals are generated by automated algorithms that analyze the market and create suggestions. It is almost similar to weather forecasts or score predictors in sports. However, signals can also give false results as the future is never determined beforehand.

Today, I will explain what trade signals are and how to trade using easy and end of the day signals. So, let’s begin.

What Is a Trade Signal

Trade signals are outputs of complex data analysis mostly done through high-end algorithms and some manual efforts. A trading signal platform converts data and market behaviors into the best possible decisions a trader can take.

These signals or indicators suggest when to buy or sell an asset. Traders use signals as guides for markets like forex, crypto, and stock.

Platforms created with tools like SignalLab simplify how people share and use these alerts. There are tons of websites that deliver premium live trade signals to users. But not all of them are trusted sources. You need to check authenticity before buying signals from a site.

How Trading Signals Work

We first consider input. Signals draw from sources such as price charts, volume data, macro news, and sentiment measures. Some algorithms include data from news feeds or social media to detect shifts in mood. Others rely purely on technical indicators.

Next comes signal logic. Some signals are crafted by experts manually. Others are machine-generated by bots or algorithms. Manual signals rely on human judgment, while automated ones use formulaic rules. These rules may combine indicators like moving averages, RSI, MACD, or pattern recognition.

Then delivery drops in. Signals often arrive via apps, Telegram, email, websites, or webhook APIs. A signal provider sends you a trade idea with an entry price, stop loss, and target. You receive it, evaluate it, then decide whether to act. The flow is: data → signal generation → delivery → trader decision → execution.

This workflow lets you respond faster than watching raw charts alone. But a signal does not guarantee success. It merely gives a candidate trade. You still need your own filter and risk rules.

Types of Trading Signals

There are various types of trade signals. You need to understand the differences before picking one for your trading profession.

Manual Signals

These come from analysts or veteran traders. They often include rationale, chart notes, and context. A manual signal might say “Buy EUR/USD at 1.1200, target 1.1300.” The human behind it may adjust based on market mood.

Algorithmic Signals

These are fully automated. The system watches the market and triggers alerts when rules are met. For example, a bot might issue a signal when a 50-day moving average crosses above its 200-day average.

Technical Indicator Signals

This is a subset of algorithmic signals. The signal derives from standard tools like RSI, MACD, Bollinger Bands, stochastic, or moving average crossovers. For example, a MACD line crossing its signal line is often treated as a signal.

Fundamental Signals

These relate to earnings reports, economic data releases, or news. Suppose a company reports strong profit—that could generate a signal to buy its stock. Or a central bank decision might trigger a forex signal.

Community / Social Signals

These come from trader communities, groups, or shared feeds. A popular trader might share a signal in a Telegram group. These may combine human insight with charting.

You’ll often see “forex signals,” “crypto trading signals,” or “stock signals.” All of them reflect a variation in how the signal is created or delivered.

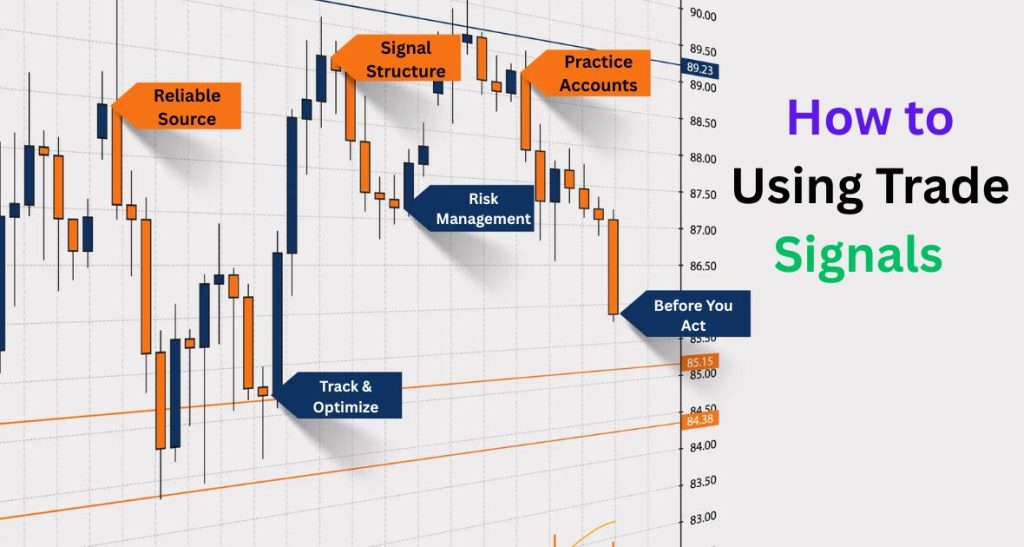

How to Trade Using Signals

Let me walk you through using signals responsibly, step by step.

Step 1: Choose a Reliable Source

First of all, you need to select a reliable trading signal provider website. You need to track records, ask for recommendations in your community, and consult your known persons to find the best trading signal website. Don’t rely on free signals from random persons. Make sure the site you’re choosing offers the best performance, transparency, and consistency in giving right signals.

Step 2: Understand Signal Structure

Note that all trading signals should come with entry, stop loss, and take profit parameters. Study deep about these levels and understand how they align with your risk tolerance.

Step 3: Use Demo/Practice Accounts First

Now, test the signals in a risk-free setting. Observe how frequent they hit targets or stop you out.

Step 4: Apply Risk Management

A general rule of thumb is you never risk your entire capital on one signal. Use position sizing and stop loss. Make sure one signal won’t clean your whole balance.

Step 5: Confirm Before You Act

Before following any signal, see if it follows your own view or filter. Signals are generated on assumptions based on real data. So, you can’t blindly follow them.

Step 6: Automate Where Possible

If you are using trading signs for some time, you should automate the actions aligning with your trustworthy stock signals in your platform. It helps to take action in time without missing any opportunity, even when you’re offline.

Step 7: Track & Optimize

Keep records of each signal in trading. It will help you understand which market signal has generated most of the profit. Record whether the trading signals hit target, how much they gained, what were the losses, and conditions these future trading signals failed. By analyzing these data manually, you can trade using signals with minimum casualties.

Note: If you apply these steps, signals can become part of your edge. They are tools, not guarantees.

Common Mistakes Traders Make: Signal Practice Problems

Signals aren’t your key to success. They suggest the paths you can choose to gain success.

Traders who blindly follow without understanding or validating the trade signals often lose their assets in a short time.

A major mistake here is ignoring stop losses and proper risk sizing. You have to understand where to stop and how much risk won’t hurt your journey.

Another thing beginner forex or crypto traders do is taking signals from free and unknown sources. Beginners overtrade following these unverified signals on adrenaline rush after seeing some profits.

Skipping past performance metrics of signals or markets is another mistake that we all do every once in a while. Always remember this in mind, never take any signal seriously to put everything on stake.

How to Identify a Reliable Signal Provider

This is a tough job for most newcomers in trading. At first, you should look for a transparent performance history of the trading signal providers. Don’t forget to check the entry/exit rules of the signal sellers.

Always avoid those providers who guarantee success or any unrealistic things. Nobody can guarantee you success or profits. It mainly depends on your strategy and risk maintaining skills.

You need to seek providers with a clear risk/reward ratio. Read community feedback and reviews.

You can also build your own signal site with SignalLab to let your fellow creators publish verified signals, show their metrics, and charge subscriptions with built-in trust.

Can You Create Your Own Trading Signal Platform?

Yes, many traders or firms have their own automated trading signal platform to run their business. Sometimes, they even serve other traders with their paid plans as well.

Creating your own forex and crypto trading signal platform has become easier with SignalLab, a PHP script by ViserLab that includes all the features you need to run a trading signal business.

Features like multi-platform notifications, complete history checks, 30+ payment gateways, 2FA, unlimited signal plan creation, etc., help you create a signal platform that anybody can trust.

And the best part is you don’t have to go through any programming work to create your own platform with the SignalLab script.

If you wish to start your own signal service, check out the details on SignalLab here.

Benefits & Drawbacks of Using Trading Signals

| Pros | Cons |

| Saves time in analysis | Risk of overdependence |

| Let’s you respond faster | Possible scam or low-quality signals |

| Emotion-free decision tool | Signals may lag or fail |

| Good for diversification | You must still verify each signal |

These pros and cons help you keep a balance. Use signals, but don’t fully trust them blindly.

Best Practices for Using Trading Signals Safely

Here are some rules you should always follow when you use trading signals to trade smarter.

- Basket new signals before live use. You should cross-check the validity manually.

- Always risk a small share of your capital per trade, no matter how big the opportunity is.

- You should have your own chart or filters to analyze market trends properly. Combine signals with them.

- Don’t be emotionally biased to any signal. Always use real-case data to analyze.

- If you have the budget, you should cross-check a signal’s validity by buying more signals from other sellers as well.

- Avoid working on multiple signals at a time.

FAQs

What does signal mean in trading?

A signal in forex or crypto trading is a recommendation or alert that helps you make decisions next. The alerts are created based on data analysis and an algorithm.

How are trading signals generated?

Signals are generated by automated systems by analyzing data, market trends, etc. The machine models also use trader logics to offer more realistic trading signals.

Are trading signals reliable?

Trading signals can become reliable suggestion sources. But the final decision is up to you. If you get trading signals from a proven source, your chance of winning might increase.

Can beginners use trading signals safely?

Yes, but they need to cross-check the validity in demo accounts and ask for recommendations from experts before buying any paid trading signal plans.

How do I start my own trading signal service?

You can buy the SignalLab script from ViserLab and customize the frontend with your brand identity. Then, easily launch and start your signal service business at a very affordable cost and effort.

Final Thoughts: Turning Signals into Success

Signals serve as tools to guide your trading decisions. If you use them wisely, with risk control, verification, and thoughtful selection, they can improve your timing and consistency.

But signals alone can’t do everything. Pair them with your strategy, discipline, and continuous learning. When you are ready to offer signals yourself, SignalLab from ViserLab gives you a fast, no-code platform to run a professional signal site. Start with signals, refine your use, and then decide whether you also build your own.